You probably have never heard of the term “glide path,” but you’ve definitely thought about it before. The rule of thumb of holding 100 minus your age as a percentage in stocks is probably the most well known glide path. Even if you’ve never thought about what percentage of stocks and bonds to hold over your lifetime, you instinctively know that your allocation to stocks should decrease as you get older. A glide path is nothing more than a relationship between your asset allocation and age.

Currently, the easiest way to implement a glide path as part of your investment strategy is to buy a target-date fund. These funds automatically shift your portfolio from stocks to bonds and cash as you get older. However there is no industry standard glide path, so each fund company uses its own, making your choice of fund company quite important. Let’s take a look at the glide paths of the three biggest target-date fund companies and an index provider: Fidelity, T Rowe Price, Vanguard, and Morningstar.

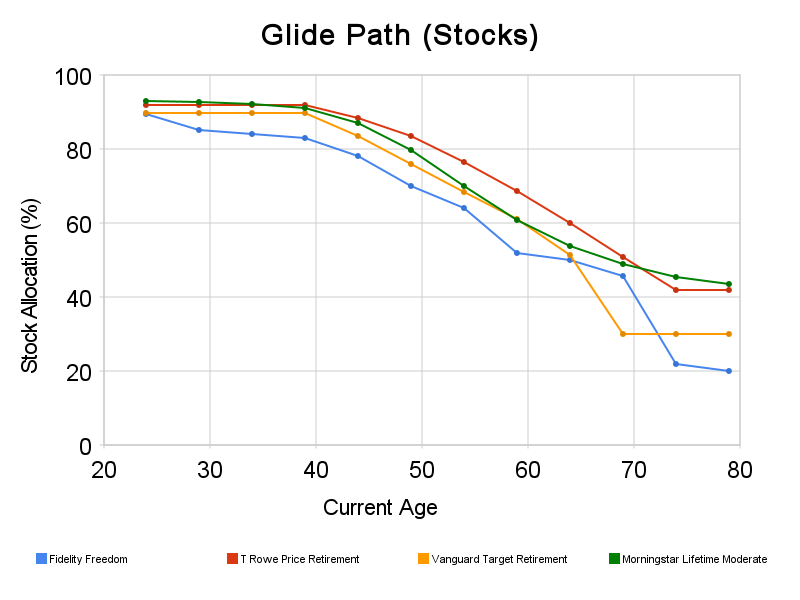

The first chart is the equity portion of the glide path (click on the chart for full size).

As you can see, although all four glide paths have roughly the same shape, the differences are material. T Rowe Price is consistently more aggressive. Fidelity is generally more conservative and has a strange kink around 65-70 years old. Vanguard puts everyone in retirement in the same fund, the earliest of the three fund companies. So a 70 year old investor would have the same asset allocation as a 90 year old.

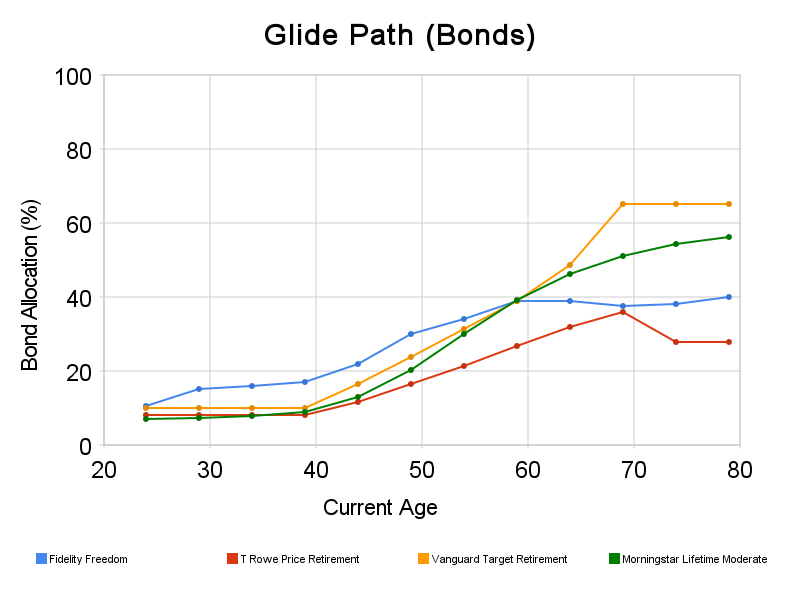

The bond glide paths are generally similar, but the differences become quite large in retirement. Again, Fidelity is generally more conservative by allocating more to bonds early on and then limiting bond exposure during retirement. Vanguard seems to stay quite aggressive in retirement by putting a significant amount in bonds, definitely more than I would normally recommend.

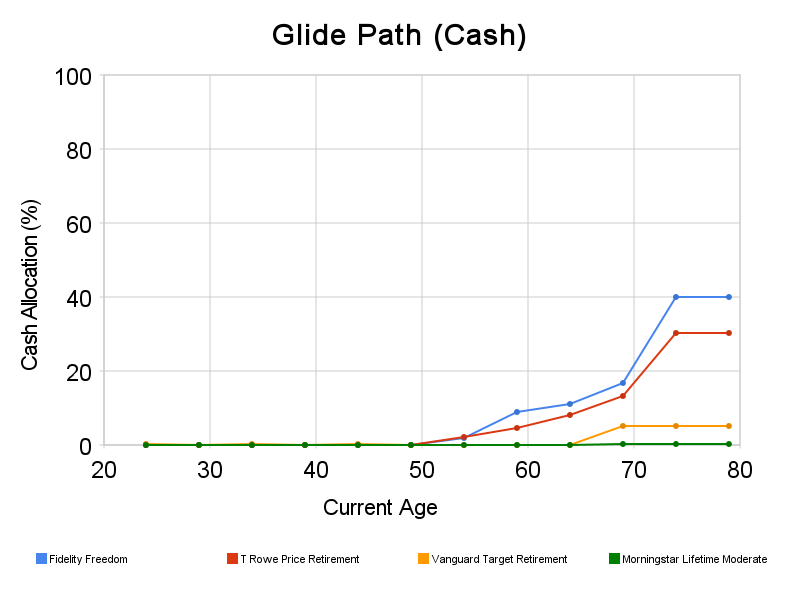

The cash portion of the glide paths are quite different. Morningstar and Vanguard put an insignificant amount in cash, even during retirement. Fidelity and T Rowe Price do a better job of reducing risk during retirement by using cash.

Although none of these glide paths may suit you exactly, using any of these would be a huge improvement over not having a long term asset allocation strategy at all. One simple way to adjust the risk level up (or down) is to buy a fund that is meant for someone 5-10 years younger (or older). If you want to implement a fully customized glide path that’s more suited to you, you can put it together using index funds and ETFs.

Some relevant links: