Last time, we discussed the overwhelming evidence that investors fail to beat a long-term asset allocation strategy (or “Basic Strategy”), by picking funds or stocks to their own detriment. Following Basic Strategy, although not very exciting, has beaten a vast majority of investors over the long term.

Fortunately, there are strategies that have succeeded in improving performance beyond Basic Strategy. One such strategy uses value and momentum measures to tilt portfolios toward asset classes that are more attractive.

Value investing tries to find investments that are cheap relative to its fundamental or historical value, while momentum investing assumes that investments that have done well recently will continue to do so. By definition, the two seem to be opposites — value prefers investments that have gone down and are cheap, while momentum prefers investments that have gone up.

Surprisingly, both strategies have worked well over time. Value over holding periods of one year or more, and momentum over holding periods of a month to a quarter.

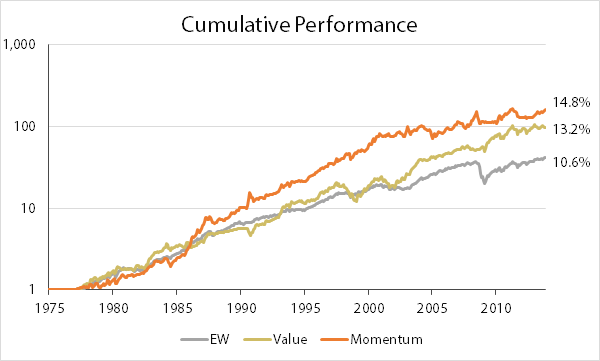

The following chart shows the performance of holding the cheapest asset class out of 6 (Value), the asset class with the strongest recent performance (Momentum), and an equal-weighted portfolio (EW). All are rebalanced monthly, except Value is rebalanced annually.

Even with a short list of 6 asset classes, value and momentum strategies have outperformed Basic Strategy by 2 to 4% per year. A long list of academic and industry research has studied and confirmed these performance effects in a wide variety of markets and time periods.

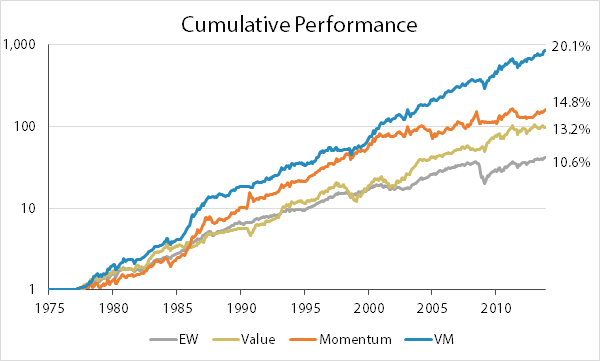

Rather than using these two strategies independently, combining the two measures into one score leads to an even stronger performance boost. The following chart includes the performance of holding the best asset class in terms of both value and momentum (VM).

Using the combined score to identify the most attractive asset class easily outperformed using either value or momentum on its own. Why does the combination work so well? Combining the two factors can avoid the common trap of buying cheap investments that are still dropping or buying rising investments that are too expensive.

For clients, we start with Basic Strategy — a fully custom, long-term asset allocation policy based on a client’s goals, time horizon, and risk preferences. Then, we tilt this allocation toward attractive asset classes based on a combination of value and momentum measures. This two-step process allows us to adjust a client’s portfolio based on market conditions, while still respecting his or her individual needs.

Note

The asset classes used in this analysis are:

| Asset Class | Index |

| US Stocks | S&P 500 |

| Foreign Stocks | MSCI EAFE |

| US Real Estate | FTSE NAREIT All Equity REITs |

| Commodities | S&P GSCI |

| US Treasury Bonds | IA SBBI US IT Government |

| US Cash | IA SBBI US 30 Day TBill |

Trackbacks