Asset Allocation with Value and Momentum

Last time, we discussed the overwhelming evidence that investors fail to beat a long-term asset allocation strategy (or “Basic Strategy”), by picking funds or stocks to their own detriment. Following […]

Should You Dollar Cost Average?

When faced with a large windfall, most investors naturally rely on Dollar Cost Averaging (DCA) to gradually invest their portfolio. The touted benefits of DCA are usually (1) avoiding a […]

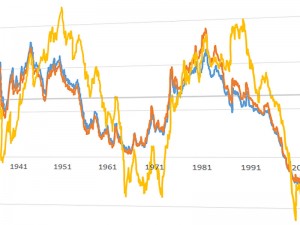

Do Interest Rates Matter?

As mentioned in the last newsletter and by like-minded analysts, current valuations point to an expensive US stock market relative to …

IPO Performance Overview

With Yelp, LinkedIn, Zynga, and Groupon completing IPOs in the past year and Facebook on the way, interest in IPOs seems to be surging. As with any investment strategy, my first reaction is to …

Valuing Real Estate (REITs)

In prior newsletters, I made the case for using the P/E ratio to value the stock market and to predict future returns. Now let’s apply the same analysis to real estate, or more specifically REITs …