Last week, I wrote a guide to choosing a target-date fund for a popular personal-finance blog, Get Rich Slowly. The guide compares target-date funds from Fidelity, T Rowe Price, and Vanguard using various criteria, including their glide paths.

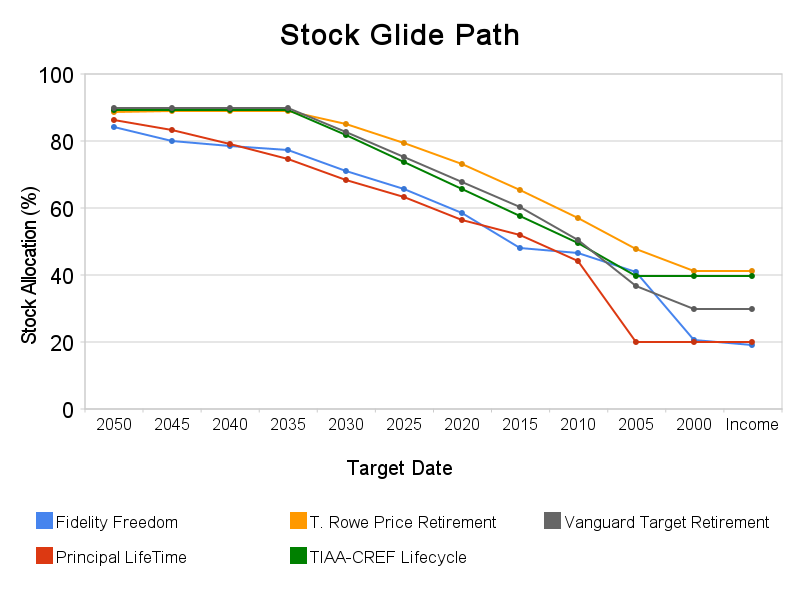

In the comments, there were questions about expanding the comparison beyond those 3 fund families. So, here’s the glide path chart expanded to 5 fund families (source: Morningstar 7/8/2010):

And to compare costs, here’s an updated list of expense ratios for their 2040 funds (source: Morningstar 7/8/2010). Vanguard is still the low-cost leader by a large margin due to its use of low-cost index funds.

| 2040 Fund | Ticker | Expense Ratio |

| Fidelity Freedom 2040 | FFFFX | 0.81% |

| T. Rowe Price Retirement 2040 | TRRDX | 0.79% |

| Vanguard Target Retirement 2040 | VFORX | 0.20% |

| Principal LifeTime 2040 Instl | PTDIX | 0.82% |

| TIAA-CREF Lifecycle 2040 Retire | TCLOX | 0.72% |

Even though they’re not ideal for everyone, target-date funds are still useful investments for many people. They’re certainly better than other strategies commonly used by beginning investors: picking stocks, picking mutual funds using past performance, or not investing at all.