Technology is definitely one of my addictions. So much so that my wife accuses me of LOOOOOVING the internet. Long before Mint came out, I used Yodlee to track my financial accounts. And in running Mariposa, I use web-based software whenever I can–I’ve even built a few integrations using their APIs.

So I’m a big believer that online services will one day provide investment advice for many investors in a more cost-effective way, similar to TurboTax for tax services. Hopefully, this will allow more investors to get the independent guidance they need.

Well, it seems that future is getting closer, as some people have already asked me about a few companies trying to fill that role. In this post, I compare how 3 new firms (MarketRiders, Betterment, and Plantly) handle investing for retirement versus the current low-tech option for beginning investors: a target-date fund.

The Options

MarketRiders is a pure advisor that designs an asset allocation strategy based on a questionnaire, suggests ETFs to execute that strategy, and then suggests initial and rebalancing trades. Any brokerage account that supports ETFs can be used, since you enter all portfolio data manually.

Betterment acts as both the advisor and the broker. You deposit your money with Betterment and use its questionnaire to decide on an asset allocation. It decides which ETFs to use and executes all trades necessary to keep your portfolio on target.

Plantly, the newest of the three, is a pure advisor that designs an asset allocation strategy based on a questionnaire and suggests ETFs to execute it. What it doesn’t yet do is suggest actual trades, since it does not know what your portfolio looks like. It will soon allow you to type in portfolio data to drive trade and rebalancing suggestions.

Target-date funds, such as Vanguard’s, are the incumbent option for do-it-yourself investors who want help with their asset allocation strategy. Vanguard acts as the advisor for the fund, and can act as your broker if you buy it directly. Asset allocations depend solely on the intended retirement year.

Features

Here’s a high-level comparison of features.

| MarketRiders | Betterment | Plantly | Target-Date Fund (Vanguard) | |

| Business Stage | In business | Public preview | Private beta | In business |

| Act As a Broker? | No | Yes | No | Optional |

| Broker Support | Any broker | Only Betterment | Any broker | Vanguard, and any broker that offers the fund |

| Account Types Supported | All brokerage accounts; 401k’s not likely (needs ETF support) | Only taxable brokerage accounts (no IRAs) | All brokerage accounts; 401k’s not likely (needs ETF support) | All brokerage accounts; 401k’s depend on employer |

| Portfolio Data Import | Typed in manually | Not necessary | Not available | Not necessary |

| Multiple Accounts Support | Aggregate yourself when entering trades; or create identical goals for each account | None | Aggregate yourself and compare vs suggested plan | Buy same fund in each account |

| Rebalancing Trades | Suggested, but execute yourself | Automatic | Calculate and execute yourself | Automatic |

| Custom Funds | ETFs only | Preselected ETFs only | Preselected ETFs only | Preselected funds only |

| Asset Allocation Customization | Questionnaire, with full overrides | Questionaire, with limited overrides | Questionnaire, with no overrides | Only by retirement year |

| Asset Allocation Changes With Age? | Manually change questionnaire answers | Manually change questionnaire answers | Manually change questionnaire answers | Automatic |

All three services aim to provide a more customized asset allocation than currently available through a target-date fund. However, with their emphasis on ETFs, they are essentially kept out of the huge market for 401k guidance. Some of the other gaps I noticed were:

- Limited support for multiple accounts for one goal (all three services)

- Manual entry for trade and position data (MarketRiders and soon Plantly)

- Need to update questionnaire responses to change target asset allocations as you age (all three services)

Costs

And now costs. For this comparison, I am using a hypothetical investor who is 30 years old, is looking to retire at 65, has $50,000 to invest, and has a moderate risk preference. For rebalancing costs, I am assuming that trades cost $8 and that the number of trades per year is equal to the number of funds.

| MarketRiders | Betterment | Plantly | Target-Date Fund (Vanguard) | |

| Annual Service Fee | $9.95 / month or $99.95 / year | 0.90% / year | TBD | $0 |

| Rebalancing Cost | Broker charges commissions separately | Included | Broker charges commissions separately | Included |

| Service Fee | $119.40 (monthly plan) | $450 | TBD | $0 |

| Number of Funds | 7 | 7 | 3 | 5 |

| Commissions | $56 | $0 | $24 | $0 |

| Average Fund Expense Ratio | 0.17% | 0.21% | 0.17% | 0.21% |

| Fund Expenses | $84.75 | $102.70 | $85.40 | $103.16 |

| Total Annual Cost | $260.15 | $552.70 | $109.40 + service fees | $103.16 |

As expected, the price point for these services is slightly higher than that of target-date funds, since they are going after investors willing to pay up for a more customized solution.

Asset Allocation

No matter how great the interface, ultimately these services are providing investment advice, so let’s evaluate what they are recommending. And since all three use questionnaires to drive their recommendations, let’s start with what they ask:

| MarketRiders | Betterment | Plantly | Target-Date Fund (Vanguard) |

| What is your age? (any age 0-70 or 70+) | How much do you plan to invest? | How much money would you like to invest? | In what year do you plan to retire? (5 year increments) |

| In how many years will you start needing this money? (any number 0-10 or 10+) | Which would you prefer in one year? (low risk or risky) | How long can you leave your investment untouched? (1, 2, 3-4, 5-6, 7-9, 10+ years) | |

| How much investment experience do you have? (none, limited, good, extensive, professional) | Which would you prefer in five years? (low risk or risky) | Choose the right balance between risk and return (very low, low, moderate, high, very high) | |

| How much risk can you handle? (lowest, low, medium, high, highest) | Which would you prefer in ten years? (low risk or risky) | Broker’s trading fees | |

| How much would you like to invest? | Rate the importance of your previous selections (low, mid, high for each) |

The questionnaires seem to focus primarily on amount to invest, investment horizon, and risk preference. MarketRiders also asks about age and investment experience, and Plantly asks about broker commissions.

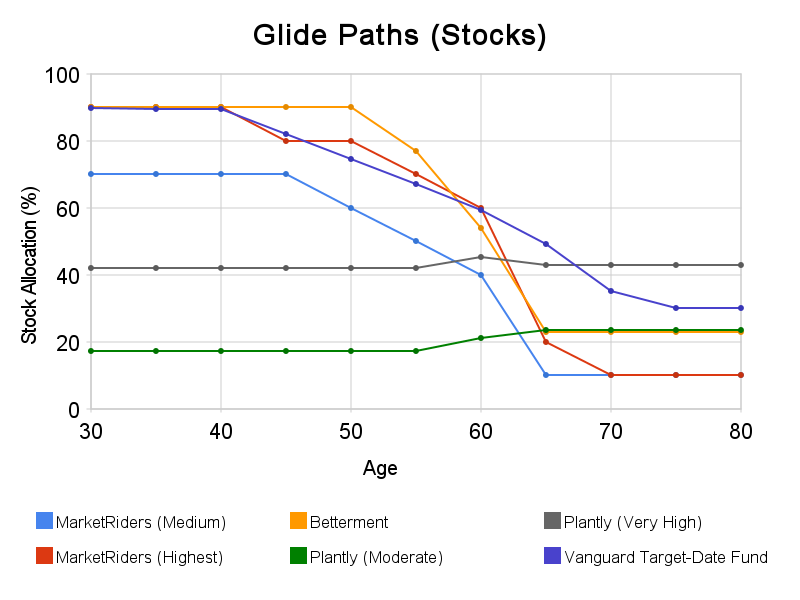

Let’s take a look at their recommendations for a hypothetical investor who is looking to retire at 65, has $50,000 to invest, and has a moderate risk preference. The following graphs the recommended asset allocations over the investor’s life (the glide path). If you’ve read my comparison of target-date funds, this should look very familiar. Note that I included real estate and commodities in the “stock” bucket.

Source: MarketRiders, Betterment, Plantly, Vanguard, and Mariposa calculations during week of 8/23/2010

As you can see, the asset allocation recommendations vary wildly. Using Vanguard’s target-date fund as the benchmark (in purple), Betterment and MarketRiders (highest risk) seem to be the most traditional, although changes seem to happen abruptly around retirement age. MarketRiders (medium risk) and Plantly use rather low stock allocations. In fact, Plantly doesn’t even follow the traditional glide path of lowering stock allocations with age.

Normally I would stop here, however, the specific asset allocations suggested by the three are so different that I will cover them in more detail in a follow-up post.

Final Thoughts

It looks like one of these services (or even some unlaunched startup) will eventually become a popular option for investors looking for something between a target date fund and a human advisor. However, the services need to improve a couple of usability issues before they can move beyond “cool toy” status for retirement investing. I will cover asset allocation issues in the follow-up post.

All three services can make it easier to save for retirement by asking for your intended retirement age in addition to age, so they can recommend changes to asset allocations as you get older without questionnaire updates. And none of the services ask about time horizons beyond 10 years, ignoring differences between goals of 10 years and 30 years for example.

The services also need to improve the importing of portfolio data. Automatically importing that information would be the only way to reach a large number of users. And if one of them comes up with a way to handle 401k accounts seamlessly, it could truly be a game-changer.

Great post, Edwin, and I’m looking forward to the next one in this series. Very odd asset allocation by Plantly–as you mentioned, it doesn’t follow the traditional glide path. Is the “traditional” glide path the right one? Are there any advantages to Plantly’s alternative?

Thanks Ben- I will make sure to discuss Plantly’s rationale in the follow-up post (coming this week). Whether the “traditional” glide path is the right one seems like a great idea for a post on its own, although I may include a short discussion of it in the follow-up.