Should You Dollar Cost Average?

When faced with a large windfall, most investors naturally rely on Dollar Cost Averaging (DCA) to gradually invest their portfolio. The touted benefits of DCA are usually (1) avoiding a […]

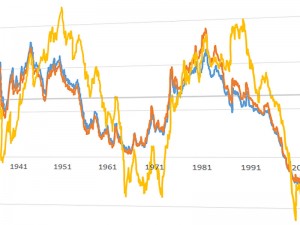

Do Interest Rates Matter?

As mentioned in the last newsletter and by like-minded analysts, current valuations point to an expensive US stock market relative to …

2011 Year-End Valuations

As mentioned last year, valuation ratios such as P/E are not very useful in making one year market predictions. This is disappointing, since they do a fair job of predicting longer-term returns of at least 5-10 years …

Valuing Real Estate (REITs)

In prior newsletters, I made the case for using the P/E ratio to value the stock market and to predict future returns. Now let’s apply the same analysis to real estate, or more specifically REITs …

2012 Year-End Valuations

Valuation ratios such as P/E are not very useful in making one year predictions, although they do a fair job of predicting longer-term returns of at least 5-10 years …