Should You Dollar Cost Average?

When faced with a large windfall, most investors naturally rely on Dollar Cost Averaging (DCA) to gradually invest their portfolio. The touted benefits of DCA are usually (1) avoiding a […]

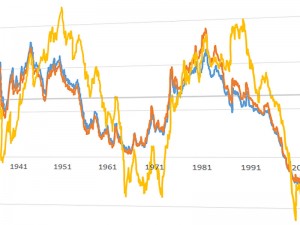

Do Interest Rates Matter?

As mentioned in the last newsletter and by like-minded analysts, current valuations point to an expensive US stock market relative to …

Asset Allocation with Restricted Stock

When thinking about restricted stock units (RSUs) in a portfolio, most consider the tax and risk consequences of holding and selling restricted stock …

IPO Performance Overview

With Yelp, LinkedIn, Zynga, and Groupon completing IPOs in the past year and Facebook on the way, interest in IPOs seems to be surging. As with any investment strategy, my first reaction is to …

2012 Year-End Valuations

Valuation ratios such as P/E are not very useful in making one year predictions, although they do a fair job of predicting longer-term returns of at least 5-10 years …