From the March 2010 newsletter:

Last time we discussed Q, which seemed to predict future 10yr returns decently well for the US stock market. This time, I introduce a valuation metric that many of you are probably familiar with, the P/E ratio. It is typically defined as price divided by earnings over the prior 12 months. The biggest problem with this definition is that earnings over one year are highly volatile, making this version of the P/E ratio not very useful.

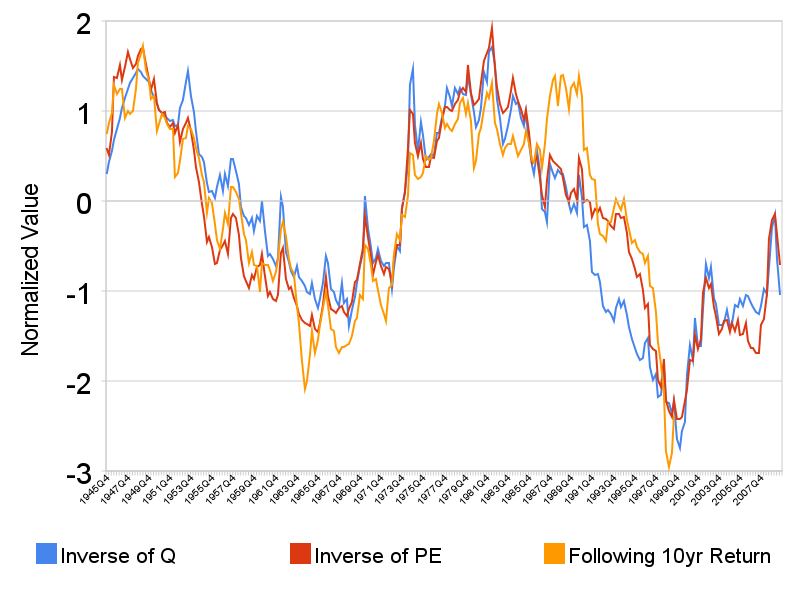

One way to make the P/E ratio more meaningful is to use earnings over a much longer period of time. Using 10 years or more of earnings is ideal. The chart below shows the P/E ratio (using 40 years of earnings!) vs Q and the following 10-year return of the S&P 500 index. It looks like this P/E ratio does a good job of predicting future 10-year returns. In fact, it’s even slightly better than Q (r-squared of 0.83 vs 0.69).

Both Q and the P/E ratio are useful metrics to estimate future stocks returns. However, like Q, the P/E ratio does not predict short term results that well. So when I recommend investing less in US stocks than your target allocation due to very high levels in Q and P/E, the intended holding period is many years.

Next time someone mentions the P/E ratio, know that it’s only useful if earnings over many years are included and you are estimating returns for at least 5-10 years. It will not help anyone guess where the S&P will end this year.

That’s true, but P/E gives indication to the relative value at the current stock price. I’d rather use P/E with LTM earnings to decide which stocks might be cheap, even if I am holding for a long horizon

Chris, if picking stocks based on P/E with LTM (last 12 months) earnings were that easy, wouldn’t more than 10% of mutual fund show market-beating ability? (See prior post)

The problem is that although low P/E stocks in aggregate have earned slightly higher returns, you would need to buy dozens, if not hundreds, of stocks to capture that small effect. For an individual, the transaction costs of buying so many stocks could easily be larger than the P/E effect itself. Further, buying low P/E stocks is a high-turnover strategy, since both price and 12 month earnings of individual companies are highly volatile. This incurs unnecessary ongoing transaction costs and taxes that does real, noticeable damage to your net returns.

The best way to capture this effect would be to include value stock index funds as part of your asset allocation, or to use fundamentally weighted index funds. Buying single stocks is definitely not the answer.