529 plans are a great way to save for college, and most offer a very simple investment option called an “age-based option.” This option automatically shifts your portfolio towards bonds and cash as your child gets older. Conceptually, this works very similarly to a target-date fund for retirement.

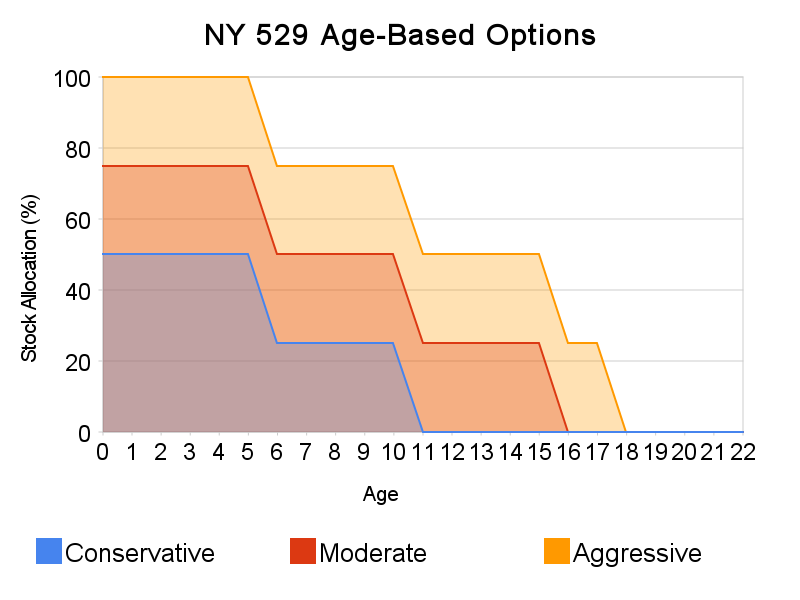

As an example, let’s consider the age-based options offered by one of the most popular 529 plans, New York’s 529 Direct plan. The table below shows how your asset allocation would change over time in their 3 age-based options. Based on your child’s age and your risk preference, you can easily identify the portfolio that the age-based option would use:

Although age-based options like New York’s are a decent solution for many investors, there are 3 problems you should be aware of.

1. Abrupt Asset Allocation Changes

The first thing I noticed about the table above is that portfolio changes happen abruptly–you jump from one portfolio to the next when your child reaches a certain age. Take a look at the stock allocations over time (investing geeks call this the “glide path”) for the three age-based options.

As expected, the stock allocation drops as your child gets older. This reduces the risk in your portfolio as college expenses get closer. What’s troubling is that these changes happen suddenly in 2-5 year intervals.

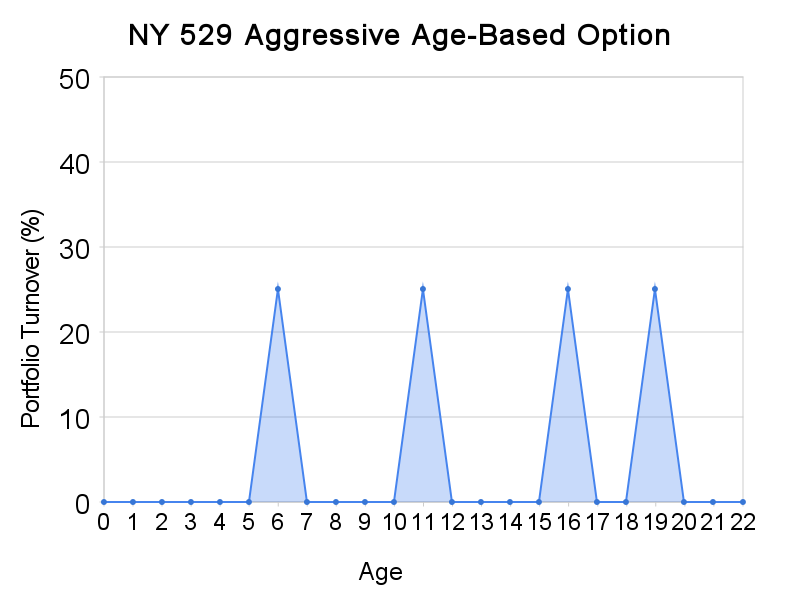

Looking at the aggressive option, it’s strange to see large portfolio changes at 4 magical ages: 6, 11, 16, and 19. What’s so special about these ages? Nothing. It seems the plan designers avoided coming up with more than a handful of portfolios, maybe because they thought a set of gradually changing portfolios would not fit nicely in their table.

Implementing gradually changing portfolios yourself would minimize the effect of stock vs bond returns in any one year. Further, your asset allocation would be tailored to someone closer to your child’s age, not someone 2-3 years younger or older.

2. Rebalancing by Age

Age-based options, by definition, use your child’s age to determine the investment portfolio. Although using your child’s age is a reasonable way to guess the timing of college expenses, it would be more accurate to simply use the year your child expects to start college. For most, this is a minor issue, but if your child is much younger or older than their classmates, this can have a material effect.

Even among students of the same age and in the same grade, asset allocations could be very different because portfolio changes are tied to birthdays, not the academic calendar. From the program brochure:

The exchange takes place annually during the month following the month of the Beneficiary’s birth date.

If age-based options changed their portfolios gradually, this arbitrary schedule probably wouldn’t matter too much. However, putting the two problems together, a student born in Jan could have a portfolio that is 25% different than their classmate born in Dec for almost a full year, even though both expect to start college at the same time.

3. Minimal Diversification

If you look at the regular investment options available in the New York plan, they include US value stocks, US small-cap stocks, foreign stocks, and inflation-protected securities. Although missing a few asset classes I would like to see (emerging market stocks, REITs, etc), there are enough to build a portfolio that is decently diversified.

For some reason, the age-based options do not use these available funds. They limit themselves to the US stock fund, the bond fund, and the money market fund. Just adding the foreign stock fund to your portfolio could noticeably increase the level of diversification, lowering portfolio risk.

These 3 problems do not necessarily make age-based options a bad idea, but you should definitely be aware of them before investing. If you’re motivated, you can easily get around these problems by building your own portfolio.

Trackbacks